An Investing Tip to Beat Inflation

- Alan J. Brochstein

- Oct 2, 2024

- 5 min read

I like exchange-traded funds (ETFs) and used to be a fixed-income professional, and I now have about 6.6% of my IRAs invested in a fixed-income ETF as of Monday. It was my first time to ever buy any fixed-income ETF. It was also my first time to buy a Treasury Inflation-Protected Security (TIPS). I am writing about this because I think think this is a good time to buy TIPS.

Before I go on, let me talk about TIPS a bit. They were introduced in 1997, when the federal government auctioned them for the first time. The government sells new TIPS with maturities of 5 years, 10 years or 30 years. TreasuryDirect, which is a U.S. official website, shares the history.

TIPS were set up to protect investors from inflation. Regular bonds pay a fixed rate of interest until maturity, and then the principal of the bond is paid at maturity. If inflation picks up, interest rates rise, and the price of bonds falls.TIPS pay a fixed rate too, but the principal amount adjusts for inflation. So, the interest payment amounts may rise (or fall), depending upon price action. TIPS don't have the downside risk of bonds due to interest rates rising.

While there are lots of different types of Treasury securities, TIPS are significant in the amount outstanding currently but a very tiny part of the overall universe. As of August, the total amount of Treasury securities outstanding was $27.6 trillion according to the Securities Industry and Financial Markets Association. The TIPS are less than 10% at $2.0 trillion. The current 7.4% is down slightly from the 7.5% a year ago.

One can always buy new TIPS or invest in securities that are outstanding already. I think ETFs, which are funds that trade on the stock exchange make sense, but there are also funds. I stumbled on them last week, when I was looking at my donor-advised fund that I set up several years ago. Perhaps I will write about donor-advised funds, which I think are a fantastic way to get a tax deduction immediately and to make contributions to charities over time, in the future.

I spend a lot of time looking at stocks! Professionally, I run 420 Investor, which provides information to subscribers who are interested in cannabis stocks. I also write articles about them at Seeking Alpha each week. I am an overly active trader of stocks on my own, but I never invest in cannabis stocks (because I don't want to create a potential conflict of interests with my subscribers). I also share my thoughts with my wife, who manages her own IRA. As overly active as I am, I don't put much attention at all into the Fran & Alan Brochstein Philanthropic Fund, which is managed at Vanguard. I am a big fan of Vanguard!

I looked at the fund for the first time this year on Thursday night, and I found that it is up a lot in 2024. I knew that I had raised cash in late 2023, when I also made some changes in the allocation to funds, but I saw that the cash level wasn't that high. As I dug in for potential uses of cash, I stumbled on their fund for short-term TIPS, which is the Vanguard Short-Term Inflation-Protected Securities Index Fund (VTSPX). It is one of several funds that invests in 0-5 year TIPS. The fund is big! It was $20.8 billion at the end of August, and there was $53.3 billion across Vanguard that were aiming to beat the Bloomberg Index. The portfolio has 27 different securities, like the benchmark index, with an effective maturity of 2.5 years. I ended up reducing my equity exposure and establishing a 33% position in this fund.

The reasons I wanted to buy this fund in my philanthropic fund were that I am very bearish on stocks and also am worried about what the market is doing with Treasury securities. I have discussed both of these issues on this blog already. The Federal Reserve just cut short-term rates, but it is expected to continue to do so at a very aggressive rate. Right after Fed moved in mid-September, I shared my thoughts about fighting the Fed here. I called out Treasury rates as being quite low, and they are up slightly now for the 5-year and the 30-year. Here are the current Treasury yields as of last night:

2-year: 3.60%

5-year: 3.51%

10-year: 3.71%

30-year: 4.07%

TIPS yields are lower, but they have declined by less than the regular Treasury yields over the past year.

I am not one who thinks that inflation will soon pick up again, but I do worry about that risk. Our government has a lot of debt, and inflation is a way that it can end up paying that off. I do understand, though, that the recent bout of inflation was due to the pandemic.

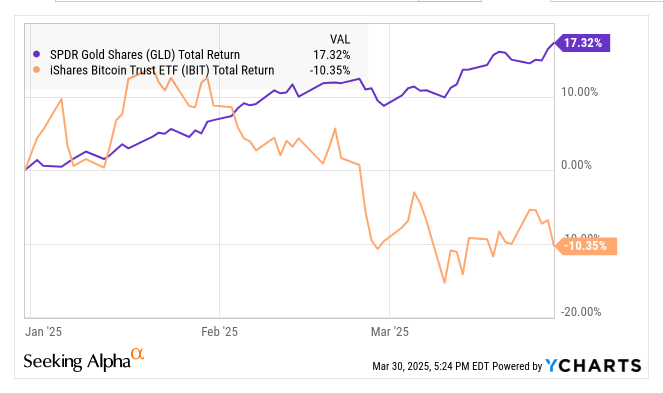

As I thought more about TIPS, I wanted to compare the total returns to another inflation protection investment historically, gold. I was a gold fan a very long time ago, but I no longer understand why many think of it as an inflation hedge. I was aware that it has been going up, and it went up more after the FOMC lowered rates. Here is a total return of gold (the SPDR Gold Shares ETF, which is valued at $73.7 billion) relative to the fund I bought over the past decade:

When inflation hit after the pandemic, gold really shot up. The returns of the TIPS fund have been good - much better than other Treasury funds, but they have trailed the price of gold dramatically. This doesn't make TIPS cheap, though. Perhaps gold is just expensive. The big rise in gold appears to be related to investors wanting to hedge against inflation, but I am no expert on this topic.

Here is a chart that goes back almost a dozen year:

Gold stunk for many years, but it has surged. I wonder if some of these buyers will discover TIPS!

Wanting to learn more about TIPS, I looked to Seeking Alpha. I found out there were two ETFs, both part of iShares, which is part of BlackRock. The one that I first identified was similar to the Vanguard fund that I had purchased, the 0-5 Year TIPS Bond ETF (STIP). It's a $7.8 billion ETF. Vanguard has an ETF too, VTIP, which is larger at $11.5 billion. VTIP and STIP have performed the same in total return, and their total return matches VTSPX.

I also discovered the iShares TIP Bond ETF (TIP), which is currently an $18.5 billion fund. It has 48 securities and a weighted average maturity of 7.4 years. TIP and STIP both have the same credit risk, but TIP has a longer effective duration. Here is how they have performed on a total return basis since the end of 2010:

During the run-up following the pandemic's start, the longer TIPS did better pricewise, but they have pulled back since the end of 2021:

The longer TIP has been outperforming STIP very recently, and I think this could continue. I ended up adding a position in TIP to my IRAs on Monday, and I made an additional investment at a higher price yesterday. The position size is 6.6%, as I mentioned above in the introduction.

For those who, like me, think that Treasuries are expensive and not so likely to come down and that stocks, especially large tech stocks, are overdone to the upside, cash is a good option. I think that TIPS, which do have lower coupons that cash, should return more. Investors need to remember that deflation can result in TIP principal payments declining with possible negative total returns. I have no bet against gold, though perhaps that is the right answer. If inflation does stick around or accelerate, it will be good for TIPS. I like the longer-dated TIP as opposed to STIP, but both make sense to me currently.

Comments